Eleonore has spoken to individuals, families, groups, associations, and corporations for over a decade to educate and create protection when the unexpected happens. And it always does. Her presentations and workbook make her the ultimate resource locator for all things financial, legal, medical, and legacy. And creates a wake-up call for participants … before the unexpected happens!

Life is full of surprises. “We love the good ones and loathe the bad ones.”

Eleonore is available for a limited number of in-person speaking engagements and unlimited Zoom consultations and presentations.

Eleonore’s most requested presentations include:

1. Discover the Emergency Basics that Will Flip Your Everyday World Upside Down

Life happens. Crises surface at the most inopportune times. You need to know the basics of what to do; who to contact; what to say; and what to do.

Takeaway: Participants will have a cheat sheet to use and resources to help.

Discover the 9 Essential Skills Every Caregiver Needs to Survive Caregiving

No matter what age family members are, sudden care for another person can cripple the entire family: emotionally, mentally, and financially.

Participants will take away the must-have 9 essential skills that will become the lifeline to avoid the chaos and confusion when caretaking descends, including:

- What is the definition of a Caregiver?

- What is Extended – Long-Term Care?

- Five Questions to Determine the Impact of Caregiving

- Building Your Care Team • Cost of Care

- Medicare – Services Not Covered

- How to Pay for the Cost of Care

- The Four Rs of Coping

- Self-Care: Stay Healthy Checklist

Download EDW Speaker One Page

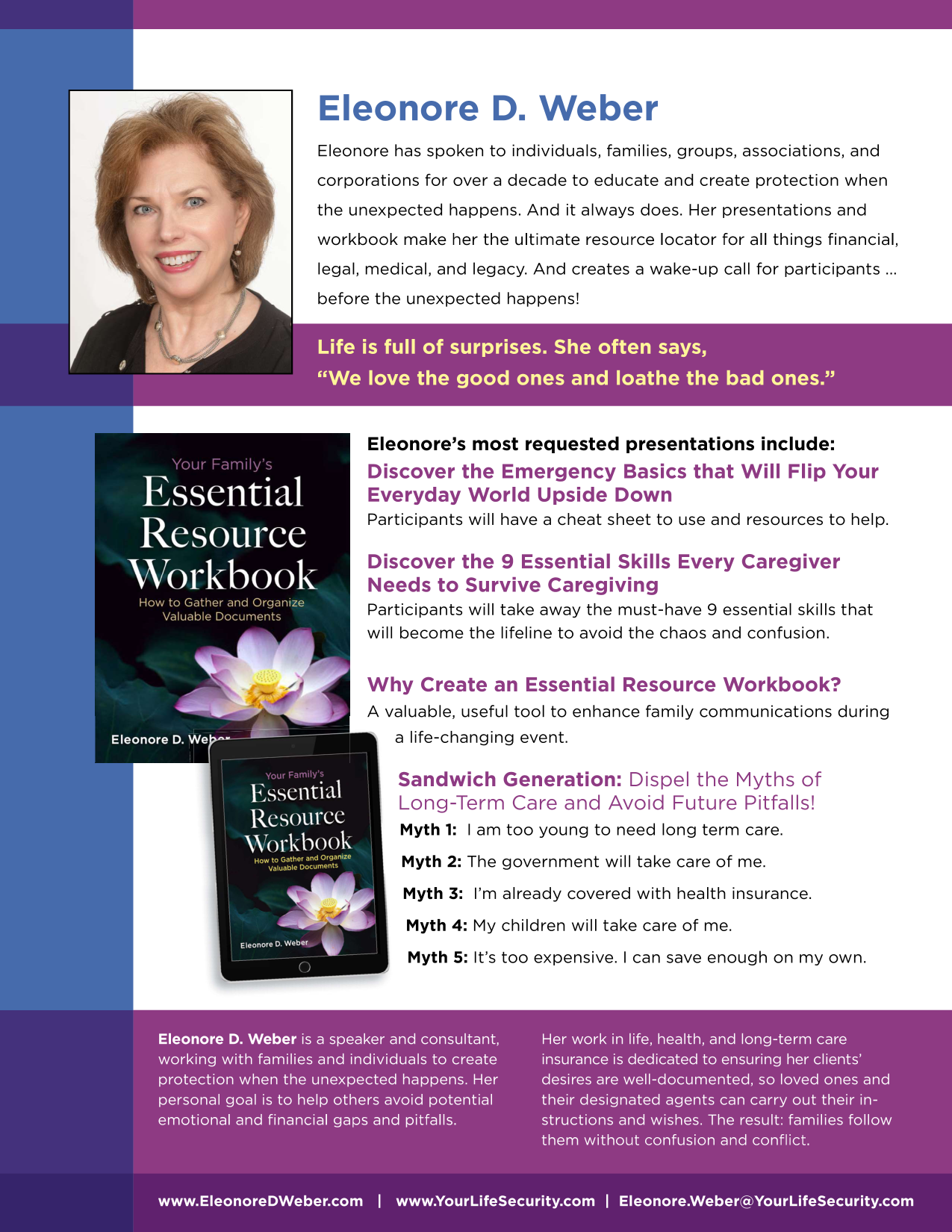

2. Why Create a Family Emergency Workbook?

In the last few years, did you or a family experience a crisis when the timing was urgent and critical, and their access to valuable information was necessary? Did the family dynamics experience increased stress, anxiety, and family friction? Was it a perfect storm for an implosion? Yet, the reality of a crisis requires patience, clear and decisive analytical thinking, and decision-making. Would it help reduce this scenario if you had Your Family’s Essential Resource Workbook? It worked for me in several family crises. And it can do the same for you and your family.

Takeaway: A valuable, useful tool to enhance family communications during a life-changing event. Discover the potential financial gaps that can jeopardize your family’s future security. Create Peace of Mind.

What Everyone Should Know About Life Insurance and Never Ask Your family means everything to you? From big moments like graduations and weddings to everyday memories like BBQs and bike rides, your family has been by your side through it all. But life can change in an instant. Continue to read the following for a few reasons to have Life Insurance and preserve your family’s lifestyle.

Why consider life insurance?

- Does someone depend on your income and financial support? That’s why!

- What are the benefits?

- Income Replacement

- Lifestyle and monthly expense replacement

- Final Expenses

- Childcare and Education expenses

- Peace of Mind and Family Legacy

3. Sandwich Generation: Dispel the Myths of Long-Term Care and Avoid Future Pitfalls!

Should you, or shouldn’t you? … that’s the question for most in the 45-year and up group. They often answer, “I’ll think about it tomorrow … or the week/month/year.” It’s time to address the elephant in the room: Should you or shouldn’t you have long-term care? That’s the question that needs to be asked and answered.

Myth 1: I am too young to need long-term care.

Myth 2: The government will take care of me.

Myth 3: I’m already covered with health insurance.

Myth 4: My children will take care of me.

Myth 5: It’s too expensive. I can save enough on my own.

Contact her through:

www.EleonoreDWeber.com

www.YourLifeSecurity.com

Life is unpredictable. Safeguard yourself and the ones you love. At Your Life Security, Eleonore’s team of experts will help you understand how to avoid potential pitfalls.

- Protecting your income from injury, illness, or accident • Premature Death

- Plan for Aging in Place

- Planning for Retirement

- Family Legacy Develop solutions that fit your specific needs.

Don’t let life catch you off-guard. Secure Your Life’s Future!

Schedule Your Group Today!

Schedule Now