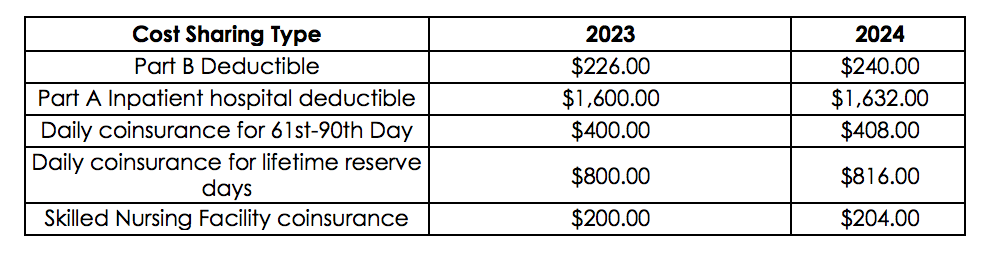

Understand Your Cost-Sharing Benefits

Medicare’s Annual Open Enrollment started October 15 until – December 7, 2023. It’s essential to understand your cost-sharing obligation under your Medicare Parts A & B, deductibles, Part D benefits. The Centers for Medicare & Medicaid Services (CMS) released its figures for 2024. Please see the below chart for your reference.

The standard Part B deductible for 2024 will be $240 from 2023 amount of $226.

The table below represents cost sharing:

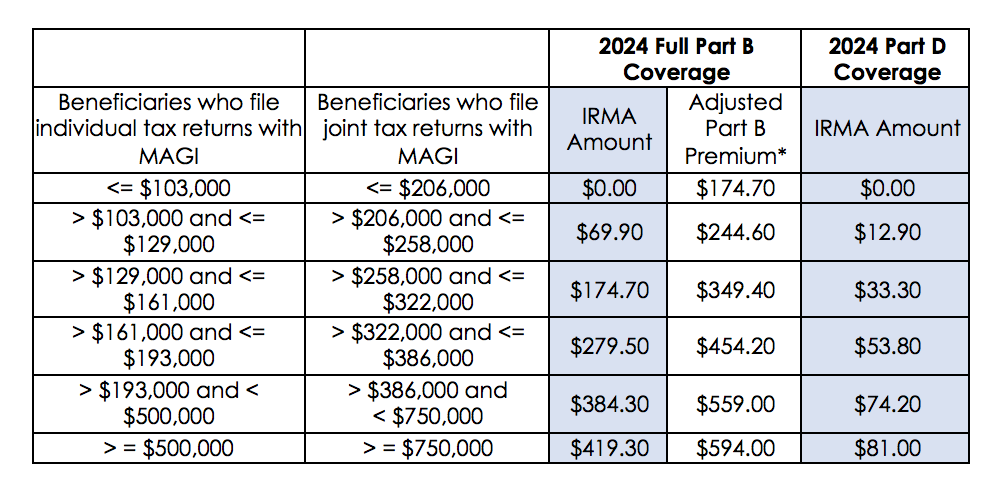

If your income (Modified adjusted gross income) is higher you might be subject to pay above the standard premium for Parts B and D. What? Yes, an extra amount which is referred to Income Related Monthly Adjusted Amount (IRMAA).

The table below represents calculations based on a single-tax filer. Please note: CMS has a two-year modified adjusted gross income (MAGI) look back for IRMAs.

* 2023 Part B Premium $164.90

For more detailed information, please refer to this linked medicare.gov page for an easier-to-understand description of Medicare costs for you.

I recommend talking to a licensed Medicare Insurance broker to discuss your Medicare questions and needs before you finalize your decision.

Start here to schedule that conversation.

See below my great news.

Eleonore Weber, CLTC

Author, Disability, Health, Life, Long-Term Care, and Medicare Insurance solutions!

Do you want to give Peace and Mind to your Family?

Do you want to give Peace and Mind to your Family?

If YES, learn about a vital family tool – Your Family’s Essential Emergency Workbook: How to Gather and Organize Valuable Documents.

A workbook designed with three essential sections on “Yourself,” Your Loved Ones,” and “Your Legacy.”ORDER yours TODAY

Sources: 2023 Medicare.gov

©Eleonore Weber, 2023 All Rights Reserved