Excellent question! Here are 5 reasons.

Recently, I had a conversation with a prospective client who said, ” we don’t have any debt. We don’t need Life Insurance!”

Unfortunately, as a young mother of two young children, I experienced how Life can change when my husband died from a lengthy illness. Thank goodness we planned for the “What If’s.” Advanced planning saved my family’s future. It allowed me to gain the emotional bandwidth to cope with the residual tasks associated with Life’s transition after a loss.

A life event or the loss of one of the two-income can dramatically impact the family dynamics. A contingency plan is advisable for all stages of life, especially for young families.

Family is everything—your history, present, and future (legacy). Consider your savings and how it’s invested. . Life insurance is a way to ensure your loved ones will have a good financial future

5 Vital Reasons to Consider Life Insurance for your Loved Ones

- Income Replacement. How would the loss of one income impact you and your family’s emotional and financial well-being? The second income can range from a loss of 10 to 100%, depending on the personal situation.

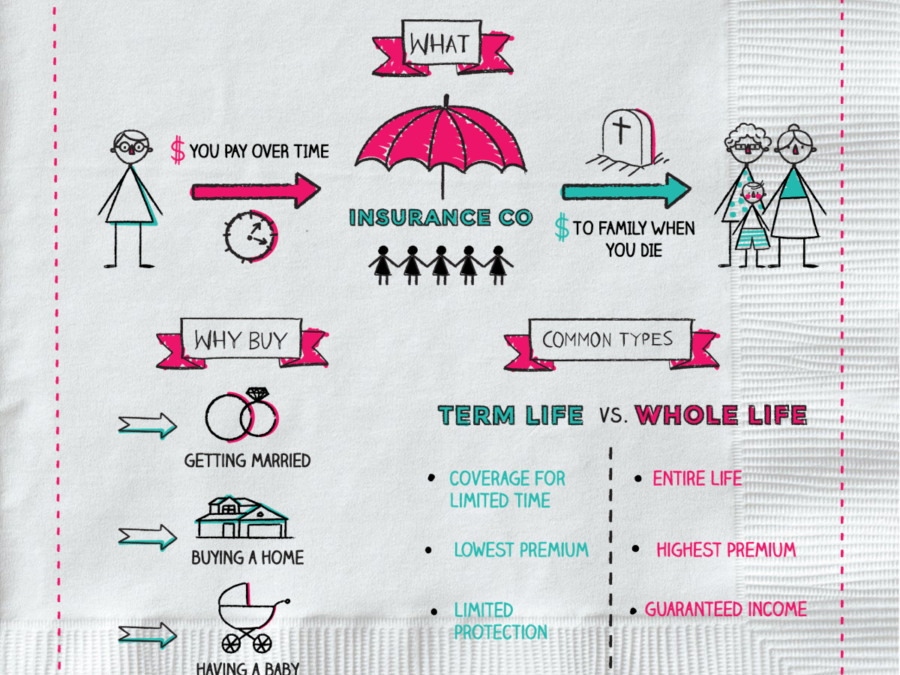

- Lifestyle and Monthly Expenses. Term and permanent life insurance policies can preserve your family’s lifestyle. In most cases, a life insurance policy can offset fixed household expenses, education, and loss of income after(?) retirement.

- Living Benefits. Funds you can access from your life insurance policy while still living are known as living or accelerated death benefits. There are other accelerated payout options for Critical Illness or Injury, Chronic Illness, and Long-Term Care.

- Child Care and Education Expense. Life insurance can help your loved ones with financial obligations, such as maintaining lifestyle, education, child care expenses, and the loss of one’s income.

- Peace of Mind and Family Legacy. Life insurance addresses the “What Ifs” and can ease the stress of wondering about your family’s future stability and wellbeing. Create peace of mind while you are healthy.

Why should you consider life insurance?

The health and well-being of your family are vital for their long-term emotional and financial security. Advanced planning, including life insurance, ensures you provided for your family’s financial security in the event of premature death.

Let me help you find the right plan. Click here to start a conversation today.

Eleonore Weber, CLTC

Your Life Security, LLC

Your resource for Disability, Health, Life, and Long-Term Care Insurance solutions. Contact us for competitive quotes for your insurance needs! – Plan for Certainty! It’s Your Life Security!

Announcement: Fall of 2021, Eleonore will launch “Your Life’s Security Essential Family Emergency Workbook. Adulting 101: Getting your Family’s Household Documents & Finances in order. The workbook is designed with three essential sections on “Yourself,” Your Loved Ones,” and “Your Legacy.”

©Eleonore Weber, Your Life Security, LLC – 2021 All Rights Reserved